In this article we are going to understand about Reliance Industries – Business Streams, Fundamental Analysis, Technical Analysis, Futures of Reliance Industries and finally is it going to next multibagger . You might have heard of Data is new Oil – yes this seems to be right phrase considering Jio’s presence with 30 crores of peoples in India, every household some how connected to Reliance Product and service right from entertainment, petroleum, retail digital , csr activities etc. Reliance has deep penetration in India.

Business Segments of Reliance Industries

Reliance has large number of brands and products lets see measure segments as per annual reports –

-

Refining and Marketing –

- Jamnagar refinary is largest in the India, it caters to largest revenue of reliance.

- Refining produces various products like Gasoline, LPG, Propylene, Aviation Fuel etc which is then distributed across India with different Brands.

- Its Petroleum Retail brands are – Reliance Gas, Reliance Petroleum Retail, Auto LPG, Trans Connect etc.

-

-

PetroChemicals

- This segment covers –

- Pharma Healthcare like medicine packs, syringes, blood bags;

- Infrastructure- Recron, RELX RelWood Relpet ;

- Transport and Automotive – metr, car mass transport tyres

- Sports – Golfballs, turfand sports wear

- Residential, Packaging – sofas, bed, cunsumer Durables etc.

- Water Storage Facility, Agri Products etc.

- Industrial products

- Petrochemical division covers most widely used products across breadth, Reliance is aspiring to be top 5 petrochemical companies in the world.

- Petrochemical division contribute to 1,72,000 crore of revenue and 30,000 crore as profit. This is second largest segment after Refining and Marketing segment.

- This segment covers –

-

Oil and Gas Exploration and Production

- You might heard of KG Basin (KG D6) which is largest exploration site for Reliance, its other Oil and Gas exploration includes – Panna- Mukta, Tapti and two CBM blocks.

- Reliance Industries has also ventures in North American shale plays – Pioneer Natural Resources and Chevron.

- Revenue contribution from this sector is 5000 crore and profit is around 1000 crore.

- Reliance Retail Division

- RIL is aggressively focusing on Retail Division after Jio as this is going to be second largest business after Jio after 5-10 years.

- Reliance Retail has various brands across India, it says they have open 10 stores a day in last two years.Here are measure retail brands –

- Reliance Fresh

- Reliance Digital

- Reliance resQ

- Reliance Smart

- Reliance footPrints

- Reliance Jwels

- AJIO

- Trends man – woman

- Reliance Retail is disrupting the entire retail industry n almost all the sectors, it is growing at exponential rate.

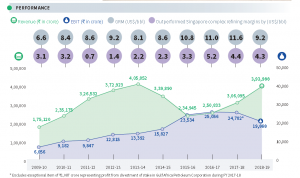

- Revenue Collected in last year is around – 1,30,000 crore and profit is around 5000 crore here is growth rate in last 10 years.

-

Media And Entertainment

- Network18 is media and entertainment network of RIL which has presence across all the segments right from News, Digital Business, Mobile Content, Filmed Entertainment etc.

- Its measure brands are –

- TV Channels & Digital News – CNBC Awaj, Colours, News India, MTV, MoneyControl

- Digital Entertainment – Voot, Cricket Next.

- Publishing Business – Forbes, Interiors, Overdrive etc.

- This segment contribute more then 5k crore in total revenue also this is growing at very high rate.

-

Digital Services Division – JIO

- JIO is revolutionary launch from Reliance, JIO has changed the entire telecom industry, Data is new Oil – it has come true. Jio has highest number of subscriber in India and world.

- Jio Ranked number 1 in Adjustd Groww Revenue(AGR).

- With Recent addition of JioFiber it is going to disrupt Broadband Industry as well.

- Revenue from its Digital Business is 46,000 crore in last year with profit of 8000 crore.

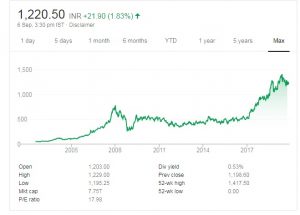

Technical Analysis

Technical analysis changes on daily basis the time passes, hence we will talk about few older chart patterns which do not depend on 1-2 month but multi year patters, support and resistance here are important points listed below –

- Reliance has formed double top at 1320 which is multiyear support for it.

- Reliance also support N Pattern which is followed very accurately, few patterns repeats by themselves, hence try to review the N pattern which it forms.

- Reliance is usually very less volatile stock – for trading purpose it good to start with as you will have lot of data from multiyears which will help in validating it in more better ways.

- Fibonacci Pattern – Reliance follows Fibonacci levels very closely, hence try to get latest level using this indicator, Using FB retracement it has support at 1231 as of today.

- Moving Averages –

- EMEA – 100 : This stock always follows points for 100 day moving averages.

- EMEA – 20 : It follows 20 day exponential moving very accurately.

- CrosssOver : EMEA 20 and EMEA200 – it gas given cross over at 500 price level after this it has given big rally.

- Option Chain Analysis : Reliance is one of the largest company which is traded across segments like Retail, DII, FII hence option chain should be looked very holistically, you should track latest option chain to find the support resistance , Bullish or bearish trend for short term or long term.

Historical Return of Reliance Share

RIL has market cap of more then 7 lac crore which is highest as of now in India, it has performed really well in last 5 year here is Share movement of last 10 years .

Historical Return of Reliance Share

| YTD | 1-Month | 3-Month | 1-Year | 3-Year | 5-Year | 10-Year | |

|---|---|---|---|---|---|---|---|

| Reliance Industries | 9.03 | 8.35 | -7.90 | -3.08 | 33.84 | 18.95 | 9.45 |

Is Reliance going to be Multi-bagger ?

This is really difficult to predict however this is definitely a compounder stock with better stability and low risk for long term. Its large business segments and its diversification of business is key to buy. Every Field whether it is digital, retail or Jio has lot of potential to capture market share across India, here are my points for keeping in my portfolio –

- Largest company of India with Presence in Each and Every field.

- Most Diverse Business across different segments

- Low Volatility , Low Risk Share with History of proven track record.

- It has capability to expand exponentially across segment.

Right time to buy Reliance Industries is now, it is definitely a must buy stock for long term investment purpose.

Tags : Reliance share, reliance industries fundamental analysis, technical analysis, why reliance share going down, when to invest in reliance share, reliance share technical analsis, jio share price, buy reliance share, reliance share analysis, best share to buy, reliance multibagger.

courtesy : most of the data is collected from RIL Annual report